Medicare Coverage Options

When it comes to choosing the right Medicare coverage, it is important to understand all of your options. We’re here to help you make the right choice – that’s the Benefit of Blue.

Why Purchase Other Medicare Coverage?

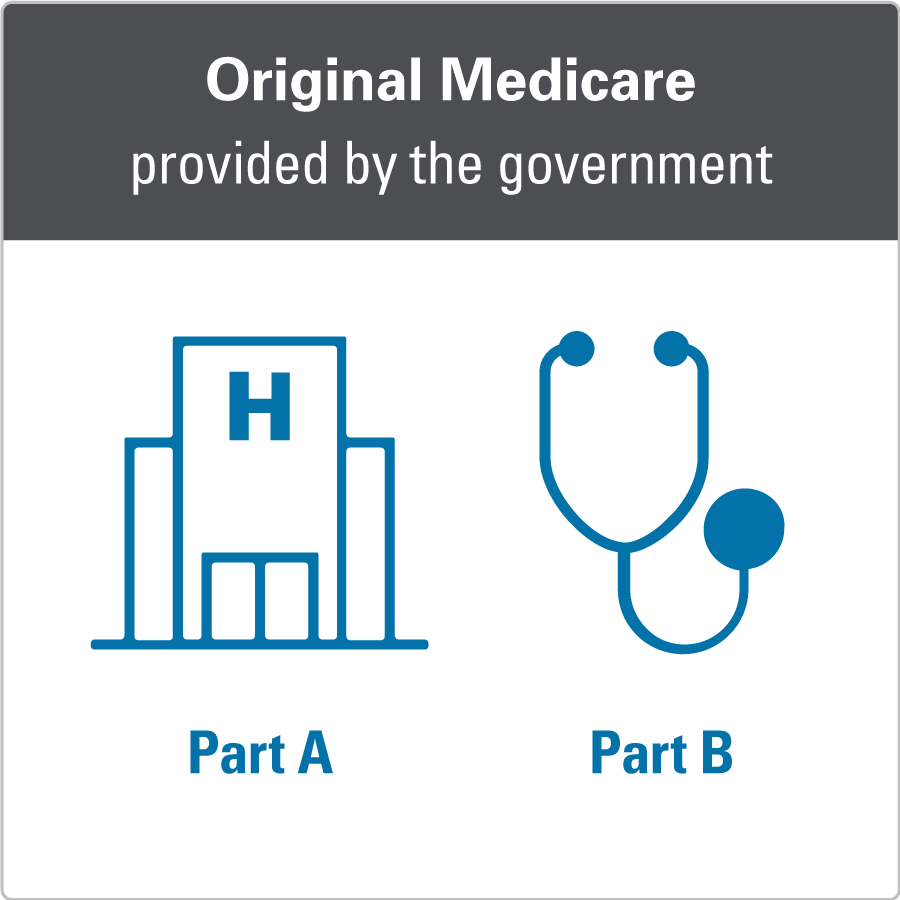

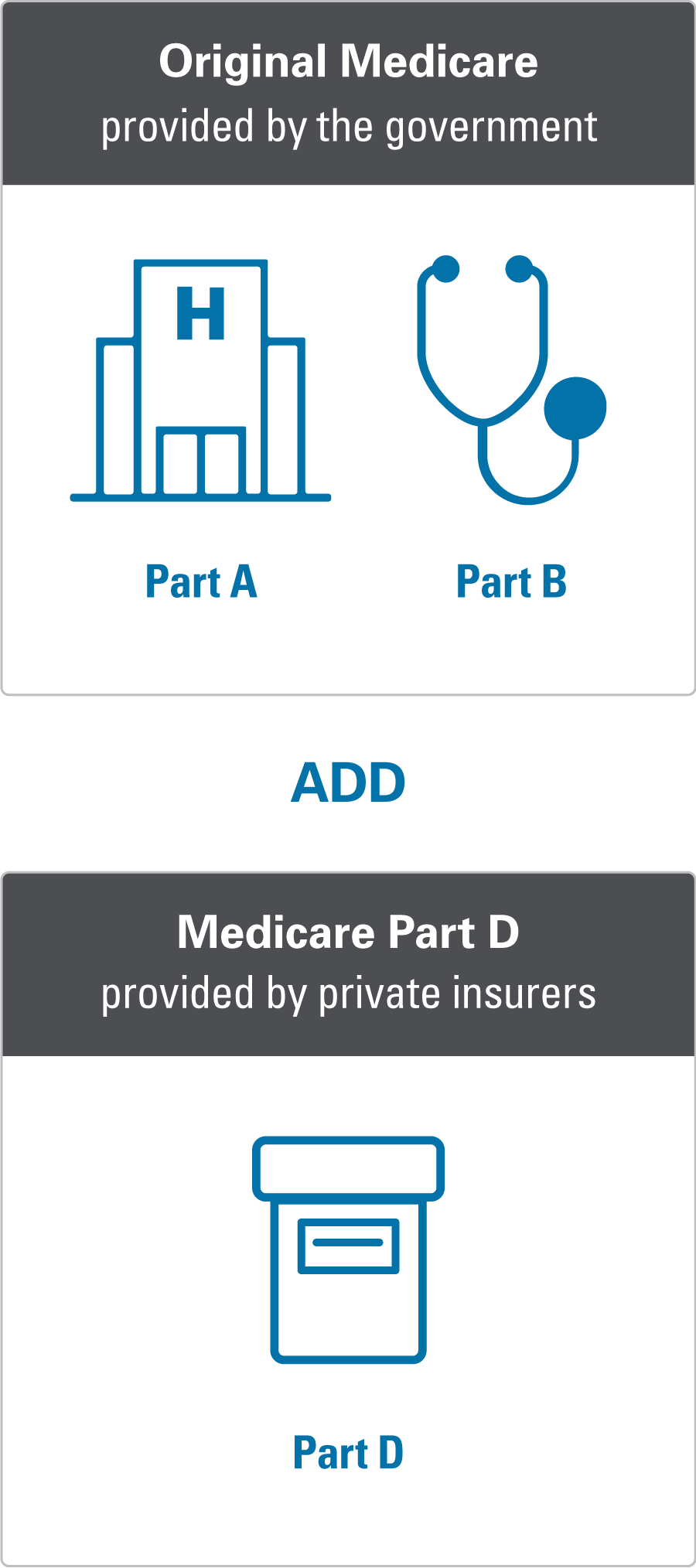

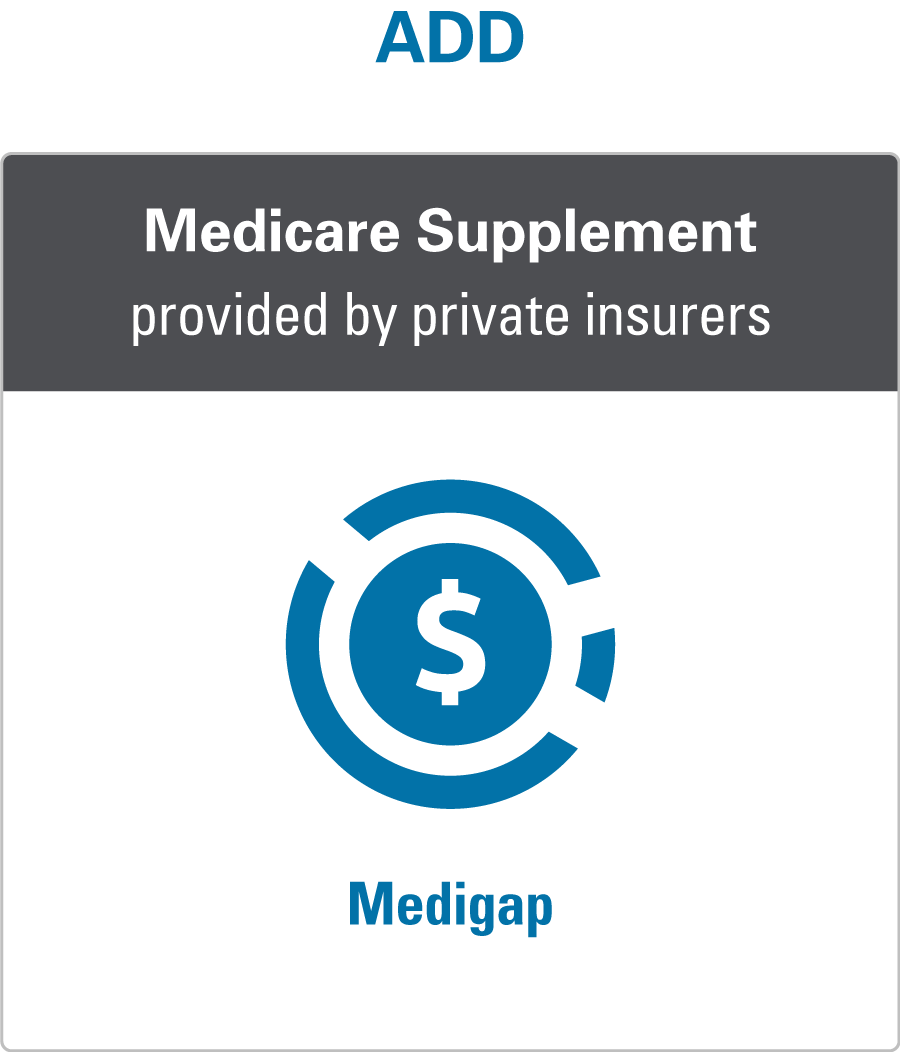

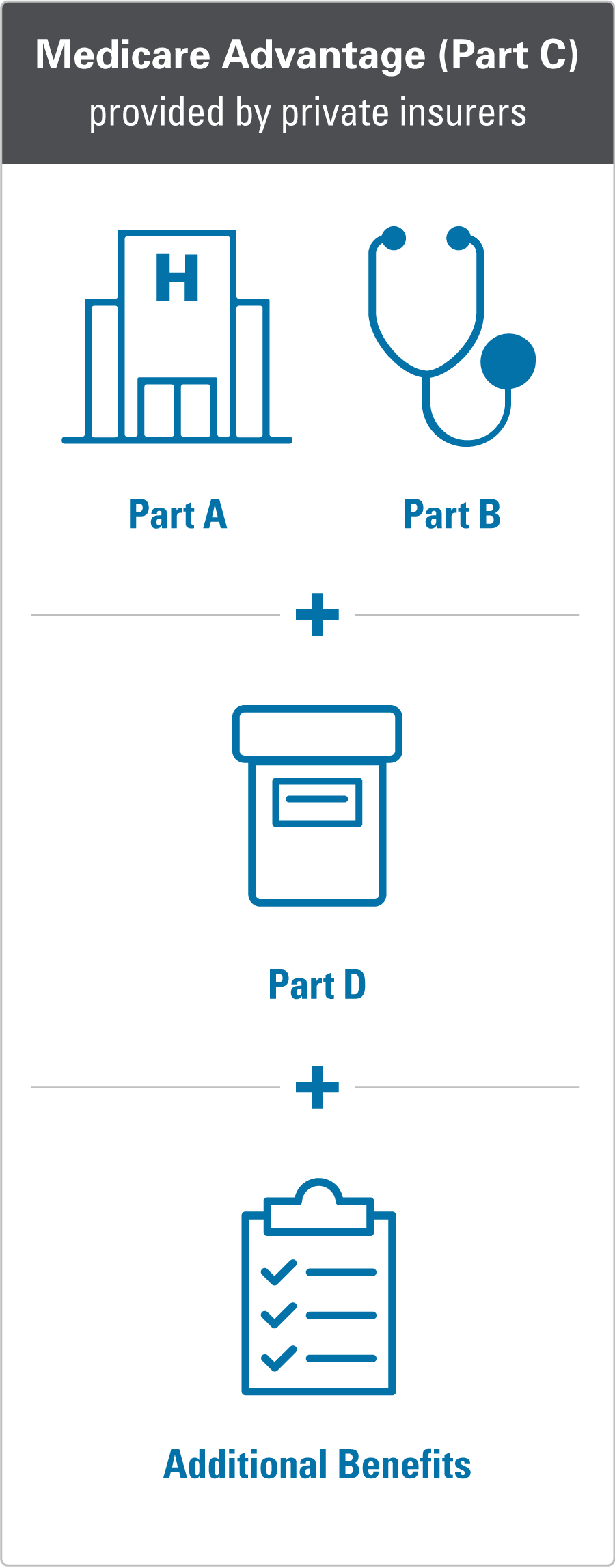

Medicare Part A and Part B (Original Medicare) do not cover all medical expenses. Additional coverage could help you better manage or limit your out-of-pocket expenses.

For example, Medicare Part A and Part B do not cover:

- Hearing aids

- Routine vision care

- Routine dental care

- Extended long-term care

- Custodial care