Hospital outpatient prices far higher, rising faster than physician sites

Payment rates for common outpatient services differ widely based on the setting where the procedure is performed — whether in a hospital outpatient department (HOPD), an ambulatory surgery center (ASC), or in a physician’s office. This study confirms and expands the results of a Blue Health Intelligence® (BHI®) issue brief from September 2023 on this critical affordability issue. There are five main conclusions based on our analysis of 123 million members from 2017 to 2022:

- HOPD common procedure prices were substantially higher — in some cases, five times more expensive — than when performed in an ASC or office setting. While there is variability in prices and costs by site of care across census divisions, HOPD prices and costs were always higher.

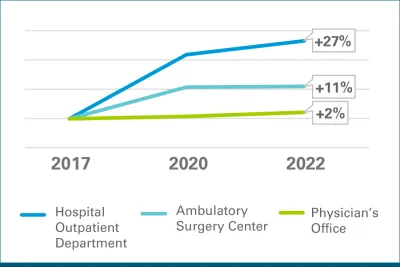

- HOPD prices grew rapidly, with a 27% average increase, compared to 11% for ASCs and 2% for physician offices.

- For services provided in HOPDs, ancillary services (such as IV placement, anesthesia, or lab tests) comprise a greater proportion of the total price compared to the same procedures performed in other settings.

- Rural providers account for less than 10% of all costs for the services examined, although they are more likely than urban areas to provide such services in a HOPD.

- Policies aimed at creating site-neutral payments — billing the same amount for the same service across care delivery settings — would result in substantial savings for patients, businesses, and employees.

Issue: Outpatient services are commonly performed in three settings: HOPDs, ASCs, and physician offices. The negotiated prices that are paid for these services vary widely depending on the setting. BHI’s September 2023 study calculated price differences for six commonly performed outpatient healthcare services and found that when those services are performed in an HOPD, the costs are substantially more than when performed in an ASC or a physician’s office. To understand the implications of these differences more fully, this follow-up study examines the cost of thousands of different services provided in these three sites of care from 2017-2022. Healthcare systems acquiring more physician practices also is a likely factor in rising costs. Though not explored in this study, other research has shown this issue is a major factor in increasing prices.1

Approach: BHI used a national commercial data set of 123 million lives to evaluate how prices differ across sites of care. BHI adopted a similar methodology to that of a recent MedPAC study by using the Center for Medicare & Medicaid Services’ (CMS) Ambulatory Payment Classifications (APC) to group and classify services. Each APC includes a set of services used to treat people with similar clinical conditions and have similar resource intensity. This allows an “apples to apples” comparison of services across sites of care.

Findings: Across thousands of services, prices are substantially higher when performed in the HOPD setting. Further, we found that for most of these procedures, the price difference grew much faster over time in HOPDs than it did in ASC or office settings. While our findings were similar for rural settings, they account for a small minority of services and costs.

Average Price Growth Rate

The Blue Cross and Blue Shield Association is an association of independently owned and operated Blue Cross and Blue Shield companies. Read more about how BCBS companies are promoting affordable health care.